In today’s fast-paced digital age, the way we manage our finances is rapidly evolving. Traditional banking methods are gradually giving way to more convenient, efficient, and secure mobile banking solutions. Bank mobile platforms have revolutionized financial management, offering users the flexibility to handle transactions, monitor accounts, and access essential banking services from the palm of their hand. With enhanced security features, seamless user experiences, and cutting-edge technology, mobile banking is becoming a cornerstone of modern financial management. This article explores the key benefits and features of bank mobile solutions, highlighting how they can help maximize banking efficiency while keeping up with the latest trends in online financial management.

Join ujiyor.net as we delve deeper into this topic.

1. Why Mobile Banking is Essential in Today’s Digital Age

In today’s digital age, the demand for convenience and instant access has made mobile banking a necessity. With smartphones becoming an integral part of daily life, banking on the go is more relevant than ever. Mobile banking provides 24/7 access to financial services, allowing users to check balances, transfer funds, pay bills, and more without visiting a physical branch. This flexibility is crucial for busy individuals who need to manage their finances efficiently. Moreover, mobile banking platforms are designed to integrate with various lifestyle needs, offering features like budgeting tools, alerts, and personalized financial insights. As society becomes increasingly digital, mobile banking is not just a trend but a vital tool for effective financial management, aligning with the pace of modern living while providing enhanced convenience and control.

2. Why Traditional Banking Methods Are Becoming Obsolete

Traditional banking methods, once the backbone of financial management, are steadily losing relevance in today’s fast-paced digital world. The need to visit physical branches, stand in long queues, and adhere to limited business hours is increasingly seen as inconvenient. Consumers now prioritize flexibility and instant access, something that traditional banking struggles to provide. In contrast, mobile banking solutions offer round-the-clock services that fit seamlessly into modern lifestyles, enabling users to perform transactions, track spending, and manage accounts from anywhere, at any time.

The rapid advancements in technology have further accelerated this shift. With robust security measures, intuitive interfaces, and personalized features, mobile banking apps cater directly to the evolving needs of consumers. In addition, traditional banking often lacks the integrated tools that mobile platforms offer, such as real-time notifications, spending analytics, and financial goal-setting features. As the world continues to embrace digital transformation, the gap between conventional banking practices and customer expectations widens.

Ultimately, the limitations of traditional banking, combined with the superior convenience and accessibility of mobile banking, make the old methods increasingly obsolete. People are gravitating towards solutions that provide instant, hassle-free financial management, making mobile banking the preferred choice for today’s consumers.

3. How Bank Mobile Enhances Financial Management on the Go

Bank mobile solutions offer unmatched convenience, empowering users to manage their finances on the go. With just a few taps on a smartphone, users can check account balances, transfer funds, pay bills, and even apply for loans, all without setting foot in a bank branch. This flexibility is invaluable for those with busy schedules or who frequently travel. Mobile banking apps often include features like real-time alerts, budgeting tools, and financial insights, allowing users to stay on top of their financial health anywhere, anytime.

These solutions also streamline financial management by consolidating multiple services into one platform, reducing the need to juggle various banking channels. Whether it’s tracking expenses, setting savings goals, or making quick payments, everything is accessible from the convenience of a mobile device. This efficiency not only saves time but also provides greater control over financial decisions, making managing money simpler and more intuitive.

4. How Bank Mobile Solutions Improve Security and Privacy

Security and privacy are top concerns in digital banking, and bank mobile solutions have risen to the challenge with advanced protection measures. Modern mobile banking apps incorporate multiple layers of security, such as biometric authentication (fingerprint or facial recognition), two-factor authentication (2FA), and end-to-end encryption, ensuring that sensitive financial data remains secure. These features significantly reduce the risk of unauthorized access, offering peace of mind to users.

Additionally, mobile banking apps provide real-time alerts and monitoring, enabling users to detect any suspicious activities immediately. Instant notifications about transactions, logins, and account changes empower users to respond quickly if any anomalies arise. Unlike traditional banking methods, which might delay fraud detection, mobile solutions offer continuous oversight.

Privacy is also prioritized through user-controlled settings that allow customers to manage who can access their financial information and how it’s shared. Banks regularly update their apps to address emerging threats, keeping security protocols up to date. Moreover, the ability to remotely lock or disable access to the app if a device is lost or stolen adds an extra layer of protection.

Overall, bank mobile solutions provide robust safeguards that not only protect financial data but also offer users greater confidence in managing their finances securely and private

5. What Features of Bank Mobile Ensure a Seamless User Experience

Bank mobile apps are designed with user experience as a priority, offering a range of intuitive features that ensure smooth and efficient financial management. The interface is often streamlined, allowing users to navigate quickly between account balances, transaction histories, and payment options. Features like quick-access menus, customizable dashboards, and simple navigation make it easy for users of all tech skill levels to manage their finances without hassle.

Personalization plays a key role in enhancing the user experience. Many apps offer tailored insights, spending summaries, and budgeting tools based on individual financial habits. This customization helps users make informed decisions with minimal effort. Additionally, real-time notifications keep users updated on account activities, upcoming payments, and spending trends.

Another critical aspect is integration. Mobile banking solutions often sync seamlessly with other financial tools, such as digital wallets, budgeting apps, and investment platforms, providing a unified financial ecosystem. Fast loading times, consistent performance, and reliable customer support also contribute to a positive user experience, ensuring that mobile banking remains convenient, responsive, and stress-free for users on the go.

6. What Key Benefits of Bank Mobile Lead to Increased Customer Satisfaction

Bank mobile solutions offer several key benefits that significantly enhance customer satisfaction. The most prominent advantage is the convenience of 24/7 access to banking services. Whether users need to check their balance at midnight or pay a bill while traveling, mobile banking provides the flexibility to manage finances anytime, anywhere. This convenience is a game-changer for today’s busy lifestyles, offering instant access without the need to visit a branch.

Speed and efficiency also play a crucial role. Mobile banking apps allow users to complete transactions, transfer funds, and perform other tasks in seconds. This reduces wait times and eliminates the need for lengthy procedures associated with traditional banking methods. Instant notifications and real-time updates further contribute to a smoother experience by keeping customers informed and in control of their finances.

Moreover, mobile banking offers personalized experiences that resonate with users. Features like spending insights, customized alerts, and budgeting tools help users tailor their financial management to their specific needs. Enhanced security measures, including biometric login and two-factor authentication, boost confidence by protecting sensitive information.

Ultimately, the combination of convenience, speed, personalization, and security leads to greater customer satisfaction. By addressing key pain points and aligning with modern expectations, mobile banking solutions keep users engaged and content with their banking experience.

7. What Future Trends in Mobile Banking You Need to Know About

The future of mobile banking is poised to be shaped by several exciting trends that promise to further transform the financial landscape. One significant trend is the rise of artificial intelligence (AI) and machine learning, which are enhancing personalization and customer service. AI-driven chatbots and virtual assistants are expected to provide more sophisticated support, while machine learning algorithms will offer even more precise financial insights and predictions.

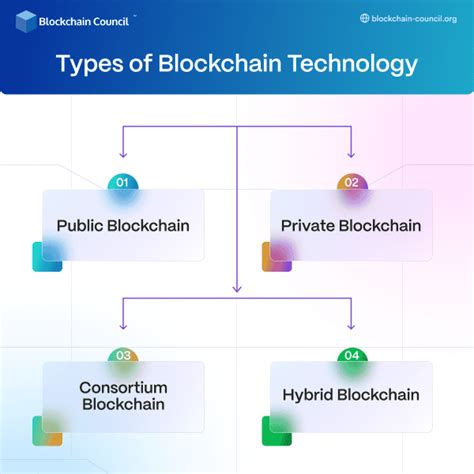

Another emerging trend is the integration of blockchain technology to improve security and transparency in transactions. Blockchain’s decentralized nature can provide an additional layer of protection against fraud and ensure more secure, transparent transactions.

Moreover, biometric authentication is set to become more advanced, moving beyond fingerprints and facial recognition to include voice and behavioral biometrics. This will further enhance security while simplifying user access.

The growth of open banking and API integrations will also enable more seamless interactions between different financial services, allowing users to manage all their financial needs from a single platform. Finally, the increased focus on sustainability and ethical banking practices will lead to more eco-friendly and socially responsible banking options.

These trends highlight a future where mobile banking continues to evolve, offering greater convenience, security, and personalization for users.

As mobile banking continues to evolve, its advantages become increasingly clear. With enhanced convenience, security, and personalized features, mobile banking solutions are revolutionizing financial management, making it more efficient and accessible. By staying ahead of technological trends and focusing on user experience, mobile banking is not only meeting the demands of today’s consumers but also shaping the future of finance. Embracing these innovations ensures a seamless and empowered banking experience.

ujiyor.net